Financial Hardship temp

RATES HARDSHIP POLICY

(Scroll down for Rates Hardship Application form)

Summary:

The purpose of this policy is to provide clear direction to Ratepayers of the application process on how to apply and what hardship relief is available.

Policy Number 1.070

File Number N/A

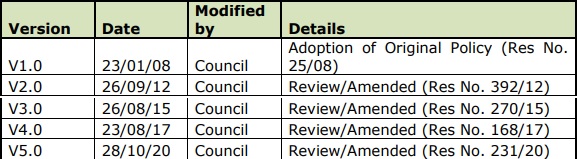

Document version V5.0

Adoption Date 28 October 2020

Approved By Council

Endorsed By Council

Minute Number 231/20

Consultation Period N/A

Review Due Date September 2023 – 3 years

Department Office of Chief Corporate

Policy Custodian Manager Finance & Technology

Superseded Documents

23 January 2008 25/08

26 September 2012 392/12

26 August 2015 270/15

23 August 2017 168/17

Related Legislation Local Government Act 1993, Local Government (General) Regulation 2005

Delegations of Authority Manager, Finance & Technology

1. Overview

To provide assistance to ratepayers, suffering genuine financial hardship, with the

payment of their rates and charges.

2. Policy Principles

Nil.

3. Policy Objectives

The Tenterfield Shire Council aims to:-

a) Consider ratepayers’ personal circumstances when assessing applications.

b) Provide a framework for ratepayers experiencing financial hardship to seek

relief.

4. Policy Statement

4.1 Payment Arrangements

Section 564 of the Local Government Act 1993 provides Council with an

option to accept payment of rates and charges due and payable in

accordance with an agreement made with the person.

Payment arrangements are to be dealt with in accordance with Council’s

Debt Recovery Policy and Writing Off of Debts Policy. However, the following

procedures will apply in respect of a payment arrangement for a person

deemed to be suffering hardship because of a rate or charge:

Procedures

The following procedures are to be read in conjunction with Council’s Debt

Recovery Policy and Writing Off of Debts Policy and will be followed with all

financial hardship concessions:

– Any mutually acceptable repayment schedules have a maximum of a 12

month term, which may be extended to two (2) years in exceptional

circumstances. Exceptional circumstances will generally entail death of a

family member, injury, and any other form of incapacitation which would

result in hardship; Variation to payment terms may be approved by Chief

Executive Officer.

– It is the responsibility of the applicant to advise Council of any changes

in the applicant’s circumstances which may affect the applicant’s ability

to honour the payment arrangement;

– Where an applicant cannot honour a payment arrangement for a short

period, for example one (1) or two (2) payments, Council will where

reasonable, accommodate an applicant where an applicant has shown a

commitment to extinguishing the debt;

– All repayment schedules are to be reviewed at the end of each six (6)

month period and upon the raising of further rates and charges;

– Any future rates and charges levied against the property are to be taken

into account when repayment schedule is negotiated to be paid by the

end of the term of hardship;

– A payment defaulter having a history of more than two (2) incidents of

payment default shall be deemed to be a person not exhibiting a genuine

commitment to extinguish the debt.

Hardship Criteria

A determination under this policy will be assessed against information

provided by the applicant upon completion of Council’s Financial Hardship

Application form including supporting documentation, but is not limited to:

– Reasons why the person was / will be unable to pay the rates and charges

when they became due and payable;

– Copy of a bank and other financial institution statements for all accounts;

– Details of all income and expenditure (monthly budget analysis);

– A balance sheet, specifying assets and liabilities;

– Letter from a recognised financial counsellor or financial planner

confirming financial hardship and advising of what procedures have been

put in place to remedy the situation.

4.2 Hardship Resulting from a General Revaluation of the Local

Government Area (Section 601 LGA, 1993)

Land valuations are independently determined by the NSW Valuer General.

Appeal mechanisms are available to landowners under the provisions of the

Valuation of Land Act 1916 No 2. Accordingly Council will not consider

applications made under this section.

4.3 Privacy

In accordance with Privacy Code of Practice and Council’s Privacy

Management Plan, personal information collected as a consequence of this

policy will only be used for the purpose of assessing eligibility under the Policy

and will not be used for any other purpose or disclosed to any other person

unless we are required by law to do so or authorised to do so by the person

whom that personal information relate.

5. Scope

This policy applies to any ratepayer who struggle to pay their rates or charges

for reason of financial hardship.

6. Accountability, Roles & Responsibility

Elected Council

Council is responsible for approving Council Policies.

General Manager, Executive and Management Teams

The Chief Executive Officer has the power to sub-delegate certain functions to

other staff members. In this case, The CEO delegates responsibility for approving

the rates hardship application and interest to be held or waived to Manager,

Finance & Technology.

Management Oversight Group – Not Applicable.

Individual Managers – Not Applicable.

7. Definitions – Not Applicable.

8. Related Documents, Standards & Guidelines

Debt Recovery Policy No. 1.041

Writing Off of Debts Policy No 1.230

Financial Hardship Application

9. Version Control & Change History

PLEASE NOTE: A download / Printable version of this application is available below